Gerresheimer AG, a leading provider of healthcare & beauty solutions and drug delivery systems for pharma, biotech and cosmetics, is further accelerating its profitable growth. The strategic program of formula G is realigning the business with megatrends such as healthcare, sustainability and biotech. Three years in implementing formula G to foster sustainable profitable growth, Gerresheimer has beaten its revenue guidance in 2021. Last year the company generated EUR 1,497m in core business revenues, achieving a strong organic growth of 7.6%. Core business adjusted EBITDA increased to EUR 324m on a currency-adjusted basis meeting the forecast range.

“2021 was a record year of growth for us. The results show our strategy is paying off: We are turning Gerresheimer into the leading provider of innovative solutions and systems for the healthcare and beauty industry. We continue to invest in key growth areas and these investments are delivering excellent results. We grew High Value Solutions revenues by more than 30%. Biological Solutions increased by more than 40%”, said Dietmar Siemssen, CEO of Gerresheimer AG, adding: “We started very strong into FY 2022, making significant progress in profitable, sustainable growth. We confirm for the running financial year to consistently deliver profitable high single-digit revenue growth and we raise our mid-term guidance: We will deliver an adjusted EBITDA margin of 23 to 25% for the Gerresheimer Group.”

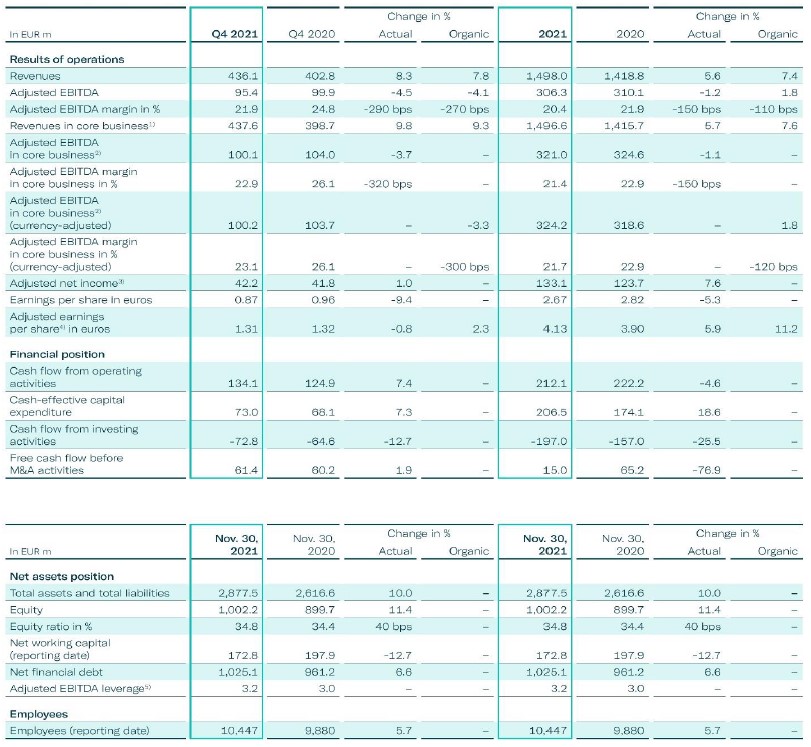

On the back of a strong organic revenue growth of 9.3% Gerresheimer AG increased reported revenues in core business to EUR 438m in the fourth quarter of 2021. The start into FY 2022 was strong and the company is in an excellent position for further profitable growth acceleration. Both divisions Plastics & Devices as well as Primary Packaging Glass contribute to this success.

The Plastics & Devices Division generated organic revenue growth of 9.9% in the fourth quarter. The demand for plastic solutions as well as medical devices was strong. The RTF syringes business showed again high single-digit growth rates. The Q4 adjusted EBITDA amounted to EUR 67m on a currency adjusted basis.

The Primary Packaging Glass Division had an organic growth rate of 8.6% in the fourth quarter 2021 due to a strong demand for both tubular and moulded glass. Clear growth drivers have been again high-value solutions such as biological solutions, ELITE glass and RTF vials as well as the cosmetics business. The Q4 adjusted EBITDA arrived at EUR 43m.

The global megatrend for injectables is unbroken. Increasing demand of vaccination-related solutions as well as the increasing focus on biological drugs and self-medication supports Gerresheimer’s growth track. The company significantly ramped-up capacity in this area in Europe, USA and Asia, which now clearly translates into profitable growth.

The adjusted EBITDA in core business came in at EUR 100m in the fourth quarter resulting in an organic adjusted EBITDA margin of 23.1%, the strongest quarterly margin of the year. The start into FY 2022 was strong and Gerresheimer is in an excellent position for further profitable growth acceleration.

For the FY 2021 the group’s adjusted net income came to EUR 133m resulting in adjusted earnings per share of 4.13 growing organically by 11.2%. Management Board and Supervisory Board are proposing a dividend of 1.25 Euro per share for FY 2021, again resulting in a pay-out ratio of around 30% and thus at the upper end of the dividend pay-out policy range of 20 to 30%.

Gerresheimer continues to successfully expand the innovation driver Advanced Technologies Division (GAT). GAT delivered in 2021 new orders, new competences and additional projects such as the new SensAir pump platform for Biologics and the smart Respimetrix inhaler. With the new autoinjector Gerresheimer expands its portfolio of owned IP devices. In addition, Gerresheimer closed an important contract with a large US biotech company for the development of a new pump.

These projects underline the innovation power of Gerresheimer. Clearly aiming for innovation leadership, the company increases its focus on research and development and own IP. The significant progress in advanced technologies projects and the increasing visibility on revenue und adjusted EBITDA contribution makes the division part of the core business. The company now guides on group level. Based on continuously improving product mix and new business models, Gerresheimer raises its mid-term guidance:

The significant progress in advanced technologies projects and the increasing visibility on revenue und adjusted EBITDA contribution makes the division part of the core business. The company now guides on group level. Based on continuously improving product mix and new business models, Gerresheimer raises its mid-term guidance:

Guidance for FY 2022 (For group level, FXN):

• Organic revenue growth: high single-digit

• Organic adjusted EBITDA growth: high single-digit

• Adjusted EPS growth: high single-digit

Mid-term Guidance (For group level, FXN)

• Organic revenue growth: high single-digit

• Organic adjusted EBITDA margin: of 23-25%

• Adjusted EPS growth: >10% p.a.