Clinical-stage biotechnology company Amgen has signed an agreement to acquire Five Prime Therapeutics for $38.00 per share in cash, representing an equity value of around $1.9bn.

Credit: Miguel Á. Padriñán from Pixabay

Subscribe to our email newsletter

Clinical-stage biotechnology company Amgen has signed an agreement to acquire Five Prime Therapeutics for $38.00 per share in cash, representing an equity value of around $1.9bn.

With this acquisition, Five Prime’s innovative pipeline gets added to Amgen’s oncology portfolio.

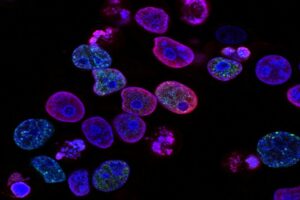

Five Prime’s lead asset, bemarituzumab, is a first-in-class, Phase 3 ready anti-FGFR2b antibody with positive data from a randomised, placebo-controlled Phase 2 study in frontline advanced gastric or gastroesophageal junction (GEJ) cancer.

The bemarituzumab Phase 2 FIGHT trial showed clinically meaningful improvements in progression-free survival (PFS), overall survival (OS) and overall response rate (ORR) in the frontline treatment of patients with advanced gastric or GEJ cancer.

Further analysis indicated a positive correlation between efficacy and expression of FGFR2b on tumour cells, thereby confirming the importance of the FGFR2b target and the activity of bemarituzumab against this target.

The deal supports Amgen’s international expansion strategy.

Gastric cancer is a common form of cancer and is particularly prevalent in the Asia-Pacific region, where Amgen expects to have significant volume growth in the years to come.

Amgen intends to tap its presence in Japan and other Asia-Pacific markets to boost bemarituzumab’s potential.

Furthermore, as part of this deal, Amgen will secure a royalty percentage on future net sales in Greater China from a pre-existing co-development and commercialization agreement between Five Prime and Zai Lab (Shanghai) Co.

Five Prime’s further innovative pipeline programmes complement Amgen’s efforts on therapies for oncology patients.

Amegen chairman and chief executive officer Robert A. Bradway said: “The acquisition of Five Prime offers a compelling opportunity for Amgen to strengthen our oncology portfolio with a promising late-stage, first-in-class global asset to treat gastric cancer.

“We look forward to welcoming the Five Prime team to Amgen and working with them to leverage our best-in-class monoclonal antibody manufacturing capabilities to supply additional clinical materials, as well as expanded production quantities, to realize the full potential of bemarituzumab for even more patients around the world as quickly as possible.”

Five Prime president and CEO Tom Civik said: “This is an exciting day for patients who may one day benefit from the promise of bemaritizumab and our full pipeline. I’m so proud of the Five Prime team and the science we’ve pioneered.

“We see tremendous complementarity between the two companies. Amgen has global reach, world-class resources, and they share our deep passion for science and commitment to patients. I have full confidence that Amgen is the right company to work with us to bring our innovative cancer treatments to patients and to achieve our mission to rewrite cancer.”

As per terms of the merger agreement, which secured approval from by the boards of directors of both companies, Amgen will launch a tender offer to acquire all of the outstanding shares of Five Prime’s common stock for $38.00 per share in cash.

After the completion of the tender offer, a wholly-owned subsidiary of Amgen will merge with Five Prime.

Shares of Five Prime that have not been tendered and purchased in the tender offer will be converted into the right to receive the same price per share in cash as paid in the tender offer

The deal is expected to close by the end of the second quarter and is subject to customary closing conditions.

Advertise With UsAdvertise on our extensive network of industry websites and newsletters.

Advertise With UsAdvertise on our extensive network of industry websites and newsletters.

Get the PBR newsletterSign up to our free email to get all the latest PBR

news.

Get the PBR newsletterSign up to our free email to get all the latest PBR

news.